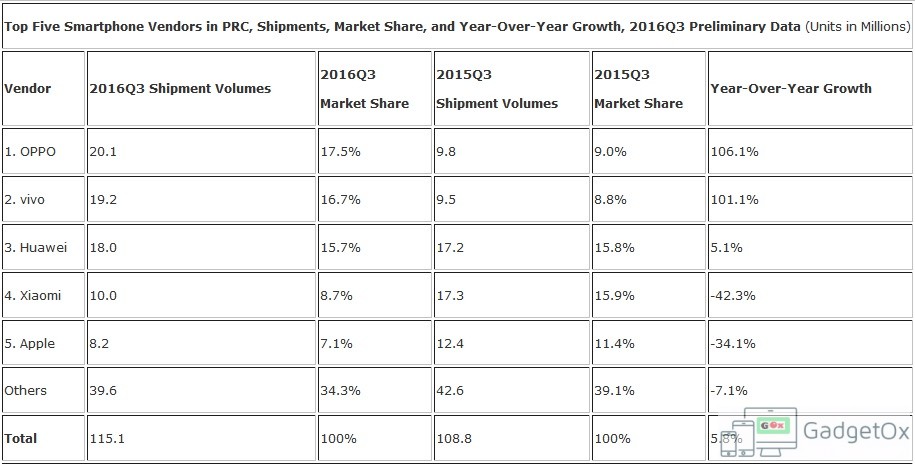

IDC has posted its China smartphone market-share report for Q3, 2016. The report brings bad news for Apple with 34% market-share erosion on a Y-O-Y basis for iPhone in China supposed to be a strong market. Apart from market-share erosion for Apple, OPPO and Vivo has also overtaken Huawei pushing it to 3rd vendor rank.

Apple was able to sell only 8.2 million smartphone in Q3, 2016 compared to 12.4 million in Q3, 2015, registering a sharp decline. OPPO and Vivo enjoyed 17.5% and 16.7% market share as compared to 15.7% for Huawei.

As per IDC’s report,

OPPO and vivo rose because the Chinese market has evolved beyond operator and online driven channels over to an offline structure that dovetails with OPPO and vivo’s strengths.

“OPPO’s success is not something that was achieved overnight. Back in the earlier years when vendors depended on operator subsidy to grow, OPPO was clear in its direction and focused on expanding its offline channels. It also had key strengths such as its VOOC fast charging technology and in the elegant design of its phones. This, coupled with its aggressive marketing tactics, helped it succeed in the market,” says Xiaohan Tay, Senior Market Analyst, Client Devices Research, IDC Asia/Pacific.

Huawei continued its momentum with its P9, and we expect the momentum for Apple to pick up in 2016Q4 where we expect its iPhone 7 to do better than the 6s. Key highlights for Xiaomi includes the launch of its Redmi Note 4 and Redmi Pro in 2016Q3.